Ira Limits 2025 Tax Bracket

Ira Limits 2025 Tax Bracket. (up from $15,500 in 2025.) $19,500 for. Federal income tax rates and brackets.

However, these changes are temporary, set to sunset at the end of 2025. This threshold is increased to $8,000 for individuals 50 and older.

2025 Tax Brackets Irs Chart Vivia Linnie, The highest earners fall into the 37% range, while those who earn the least are. The seven federal income tax brackets for 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

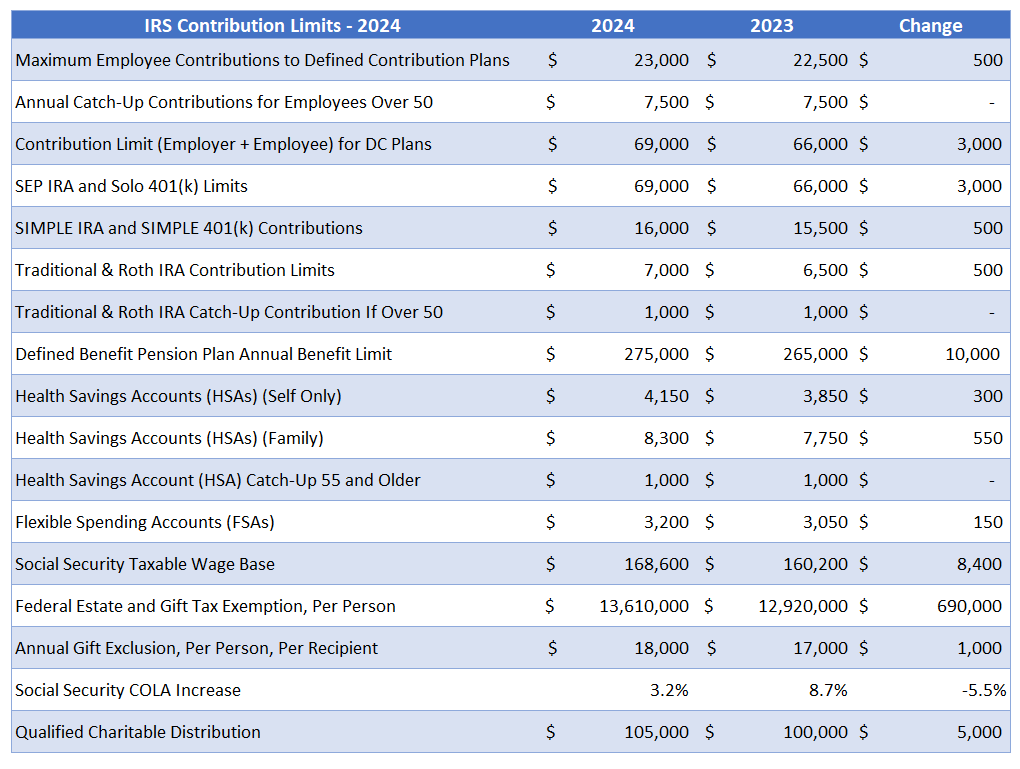

2025 IRS Contribution Limits For IRAs, 401(k)s & Tax Brackets, $16,000 for anyone under age 50. This threshold is increased to $8,000 for individuals 50 and older.

Traditional Ira Tax Deduction Limits 2025 Eryn Odilia, The lowest bracket remained at 10%, and the 35% bracket was also unchanged. For the 2025 year, individuals under the age of 50 can contribute $7,000 to an ira.

IRS Unveils Adjusted Tax Brackets and Retirement Limits for 2025, Federal income tax rates and brackets. Under the new tax regime, a resident individual (whose net income does not exceed rs 7 lakh) can avail rebate under section 87a.

Traditional Ira Tax Deduction Limits 2025 Eryn Odilia, You pay tax as a percentage of your income in layers called tax brackets. The internal revenue service recently released updated income tax brackets, standard deduction, and retirement contribution limits for the 2025 tax year.

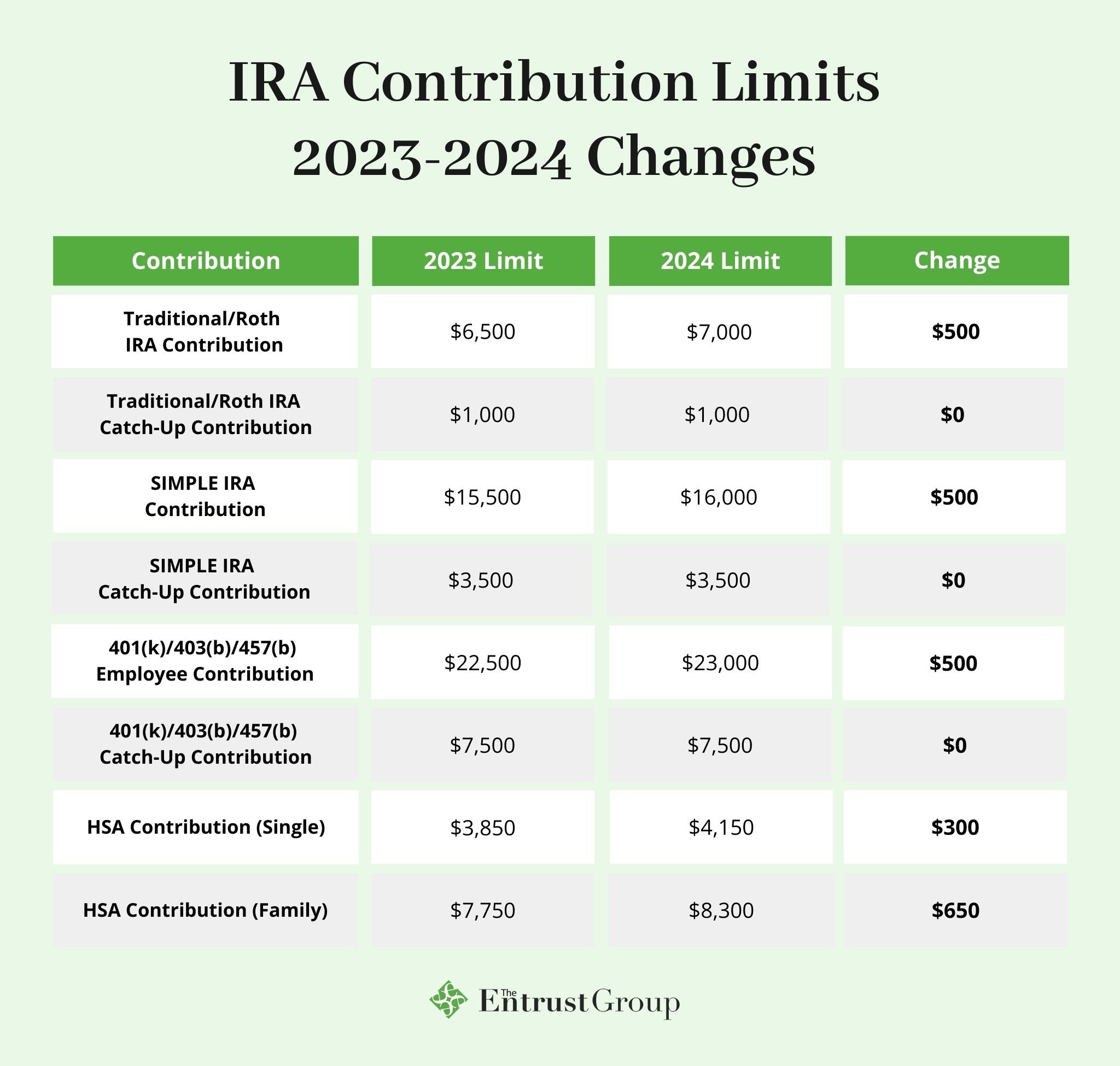

2025 Tax Brackets Vs 2025 Tax Brackets Alina Beatriz, (up from $15,500 in 2025.) $19,500 for. The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

401k Roth Ira Contribution Limits 2025 Clio Melody, (up from $15,500 in 2025.) $19,500 for. The contribution limit for roth ira and traditional ira accounts is increased to $7,000.

2025 For 2025 Irmaa Brackets Kylie Kaylee, The internal revenue service recently released updated income tax brackets, standard deduction, and retirement contribution limits for the 2025 tax year. The tax year 2025 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from $7,430 for tax.

Year End Look At Ira Amounts Limits And Deadlines, The amount of rebate is 100 per. Under the new tax regime, a resident individual (whose net income does not exceed rs 7 lakh) can avail rebate under section 87a.

Maximum Home Office Deduction 2025 Irs Vanya Jeanelle, Discover strategies to lower your tax bracket. Ira contribution limits have also increased to $7,000 for 2025, compared to $6,500 for 2025.

Individual retirement account (ira) contribution limits are also rising to $7,000, up by $500 from 2025.