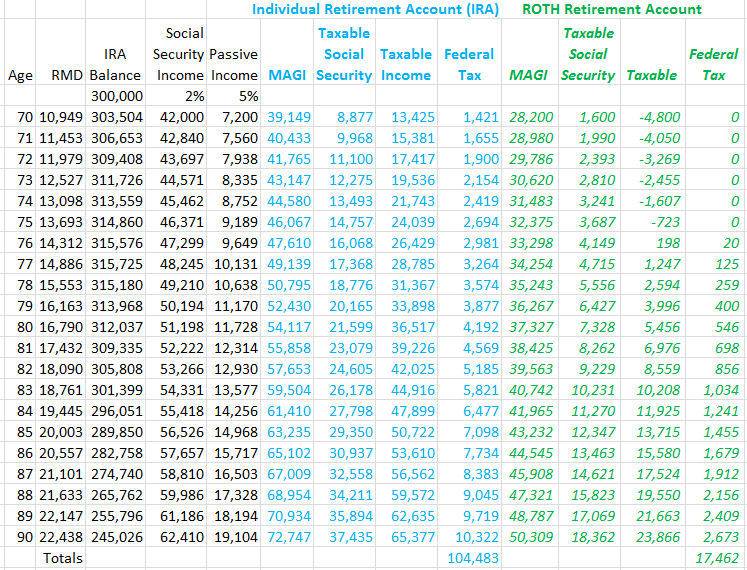

Ira Minimum Distribution Table 2025

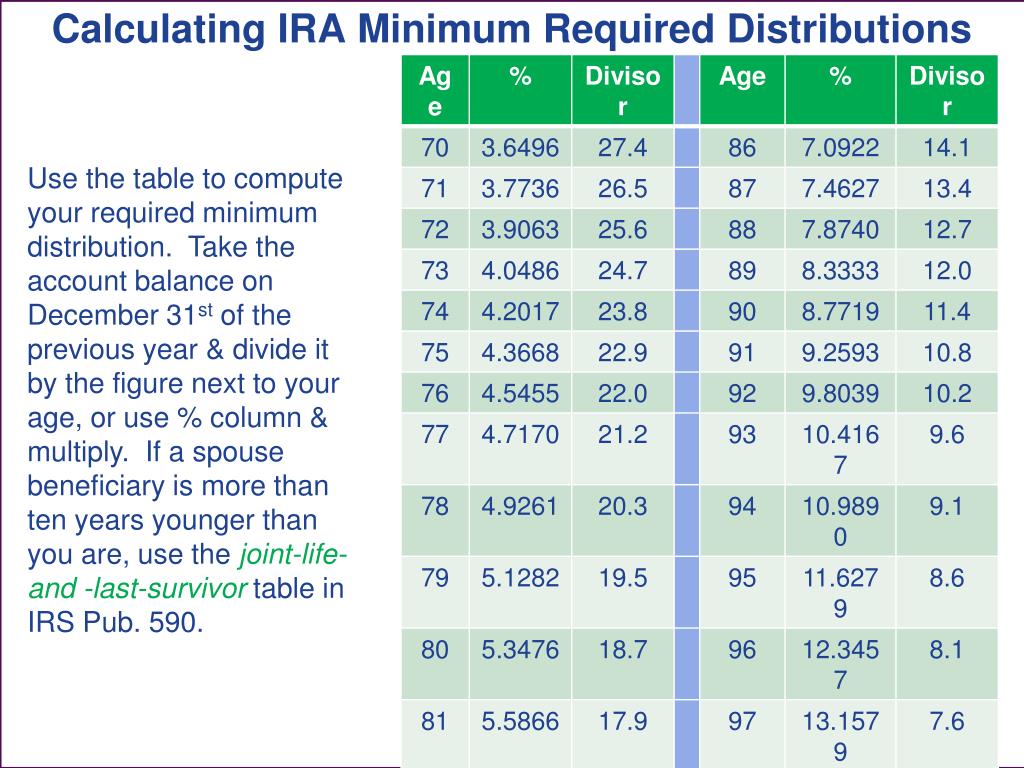

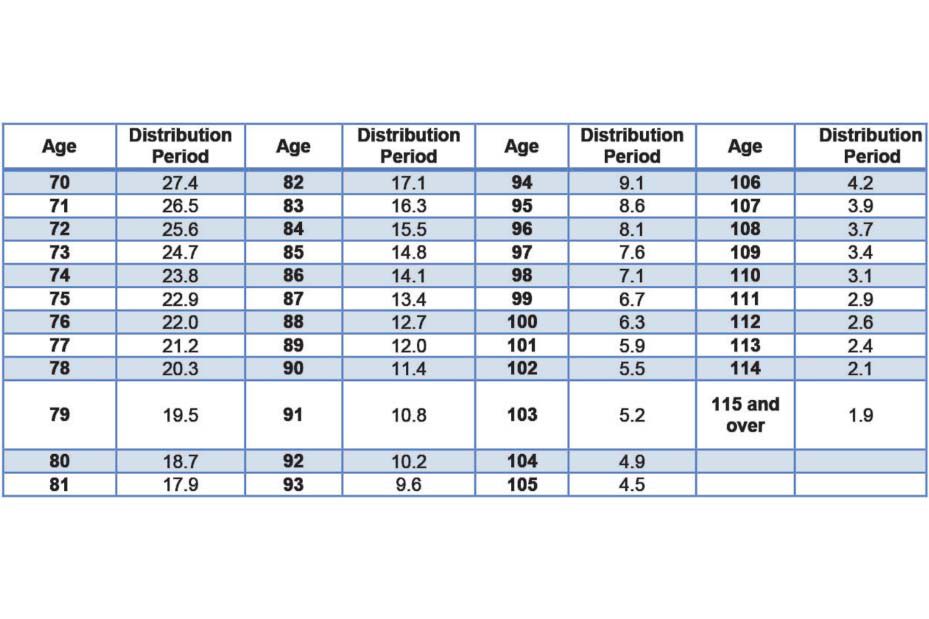

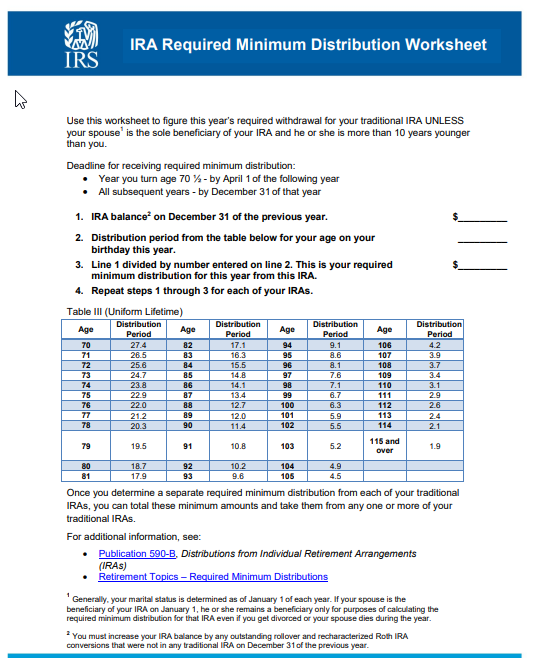

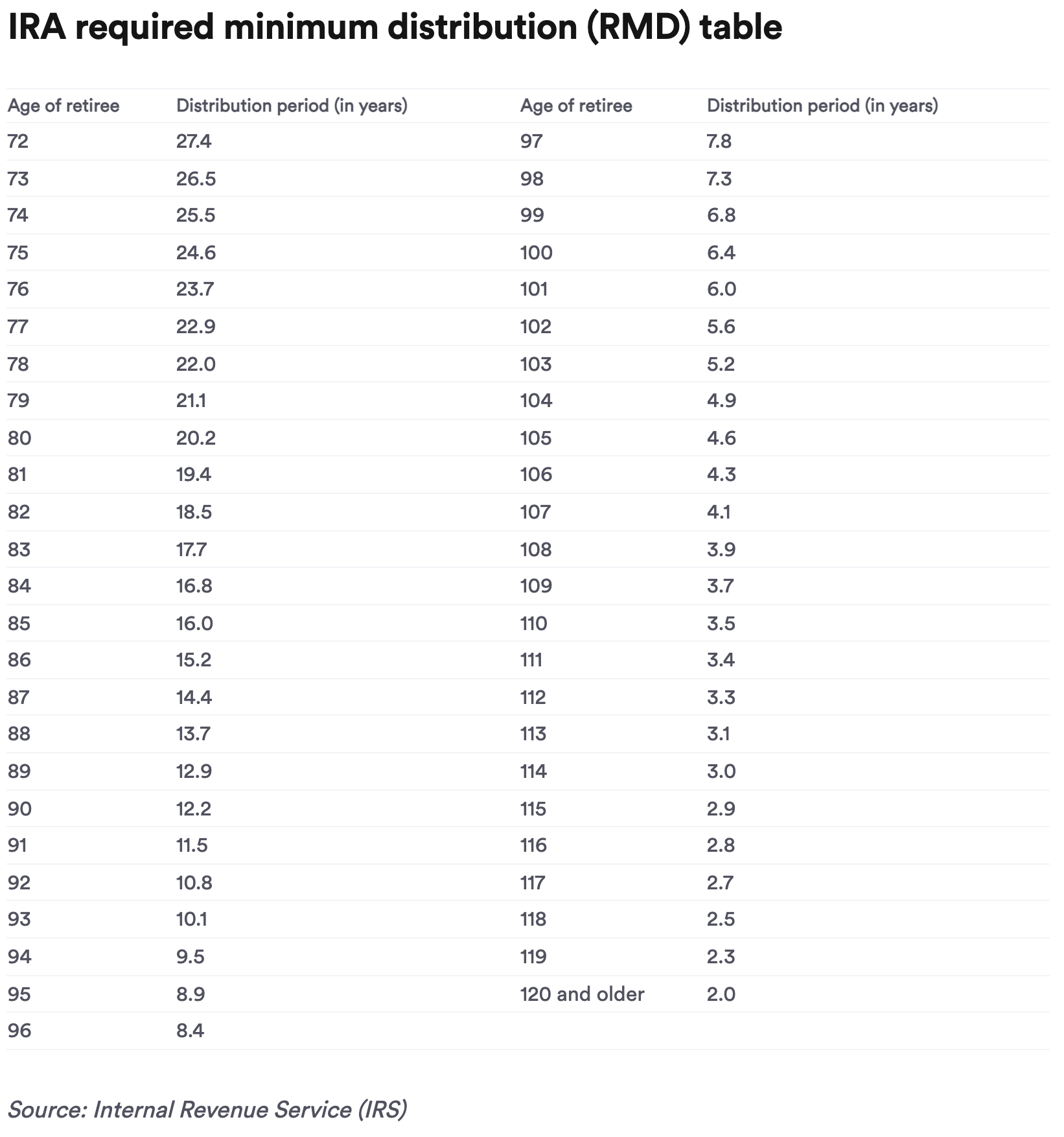

Ira Minimum Distribution Table 2025. Use this calculator to determine your required minimum distribution (rmd) from a traditional 401 (k) or ira. In general, your age and account value determine the amount.

Use this calculator to determine your required minimum distributions (rmd) from a traditional ira. Plus review your projected rmds over 10 years and over your lifetime.

PPT Steps to Financial Independence PowerPoint Presentation, free, In general, your age and account value determine the amount. For 2025, the irs allows seniors age 70 1/2 or older to make a qcd of up to $105,000 from their ira.

Rmd Calculation Table For Inherited Ira, When you hit a certain age, you must start taking a minimum amount from your ira. In general, your age and account value determine the amount.

Irs Actuarial Tables For Ira Awesome Home, The required minimum distribution for the year of the owner's death depends on whether the owner died before the required beginning date, defined earlier. Use our rmd table to see how much you need to take out.

Ira Minimum Distribution Table Matttroy, Here are projections for the 2025 irmaa brackets and surcharge amounts: This calculator allows you to assist an ira owner with calculations of the required minimum distribution (rmd) which must be withdrawn.

Ira Required Minimum Distribution Table, Use smartasset’s rmd calculator to see what your required minimum distributions look like now and in the future. The best part is that qcds count toward your required minimum distributions.

+IRS+table+percentages.jpg)

Irs Ira Required Minimum Distribution Table, If the owner died before the required beginning date,. The first rmd year is the calendar.

Irs Ira Minimum Distribution Worksheet Studying Worksheets, How to calculate your required. What are required minimum distributions (rmds)?

Required Minimum Distribution Table For Inherited Ira Elcho Table, Use this calculator to determine your required minimum distributions (rmd) from a traditional ira. A required minimum distribution is money that must be taken out of a retirement savings plan.

Rmd Requirements 2025 Grata Karlene, If you're turning age 73 this year, it's time to start taking the annual required minimum. This calculator allows you to assist an ira owner with calculations of the required minimum distribution (rmd) which must be withdrawn.

Roth Ira Required Minimum Distribution Table Elcho Table, What's new with required minimum distributions? In general, your age and account value determine the amount.

An rmd is the minimum amount of money you must withdraw annually from your qualified retirement plans after reaching age 73.