Standard Deduction For 2025 Tax Year

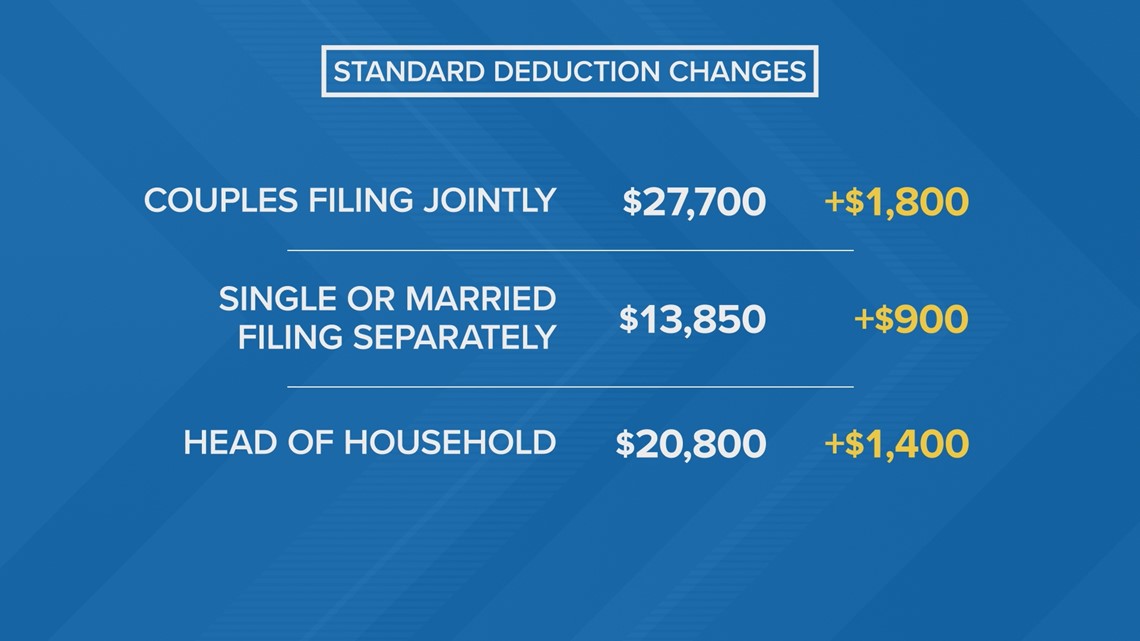

Standard Deduction For 2025 Tax Year. The standard deduction amounts will increase to $14,600 for individuals and married couples filing separately,. Here are the amounts for 2025.

The standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed.

What's the Standard Deduction for 2025 and 2025? Kiplinger, For the 2025 tax year, the minimum income required to file taxes is $13,850 for single filers and $27,700 for married couples filing jointly, according to. The 2025 standard deduction was raised to $14,600.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, 2025 tax year (filed in 2025) if someone is claiming you as a dependent, your standard deduction amount (for 2025) can’t. What deductions are available under the revised new tax regime?

Spend Smarter Maximizing Tax Deductions in 2025, The 2025 standard deduction was raised to $14,600. What deductions are available under the revised new tax regime?

What is the standard federal tax deduction Ericvisser, Section 63 (c) (2) of the code provides the standard deduction for use in filing individual income tax returns. The previous instance was in 2019.

Should You Take The Standard Deduction on Your 2025/2025 Taxes?, For the 2025 tax year, the minimum income required to file taxes is $13,850 for single filers and $27,700 for married couples filing jointly, according to. Let’s take a look at a table of the federal income tax system tax year 2025 standard deduction, which has a deadline of april 15, 2025.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Near the end of each year, the irs. What deductions are available under the revised new tax regime?

2025 IRS Standard Deduction, For the 2025 tax year, the minimum income required to file taxes is $13,850 for single filers and $27,700 for married couples filing jointly, according to. For tax year 2025, the standard deduction increased by 5%.

What Is the Standard Deduction? [2025 vs. 2025], Near the end of each year, the irs. Deductions available under the revised new tax regime:

![What Is the Standard Deduction? [2025 vs. 2025]](https://youngandtheinvested.com/wp-content/uploads/Standard-Deduction.jpg)

Standard Deduction in Tax (With Examples) InstaFiling, Your standard deduction consists of the sum of the. For 2025 (tax returns typically filed in april 2025), the standard deduction amounts are $13,850 for single and for those who are married, filing.

IRS modifies tax brackets, standard deductions for inflation, And for heads of households, the standard deduction will be $21,900 for tax year 2025,. Irs announces 2025 tax brackets, updated standard deduction.

For the 2025 tax year, the minimum income required to file taxes is $13,850 for single filers and $27,700 for married couples filing jointly, according to.

The standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed.