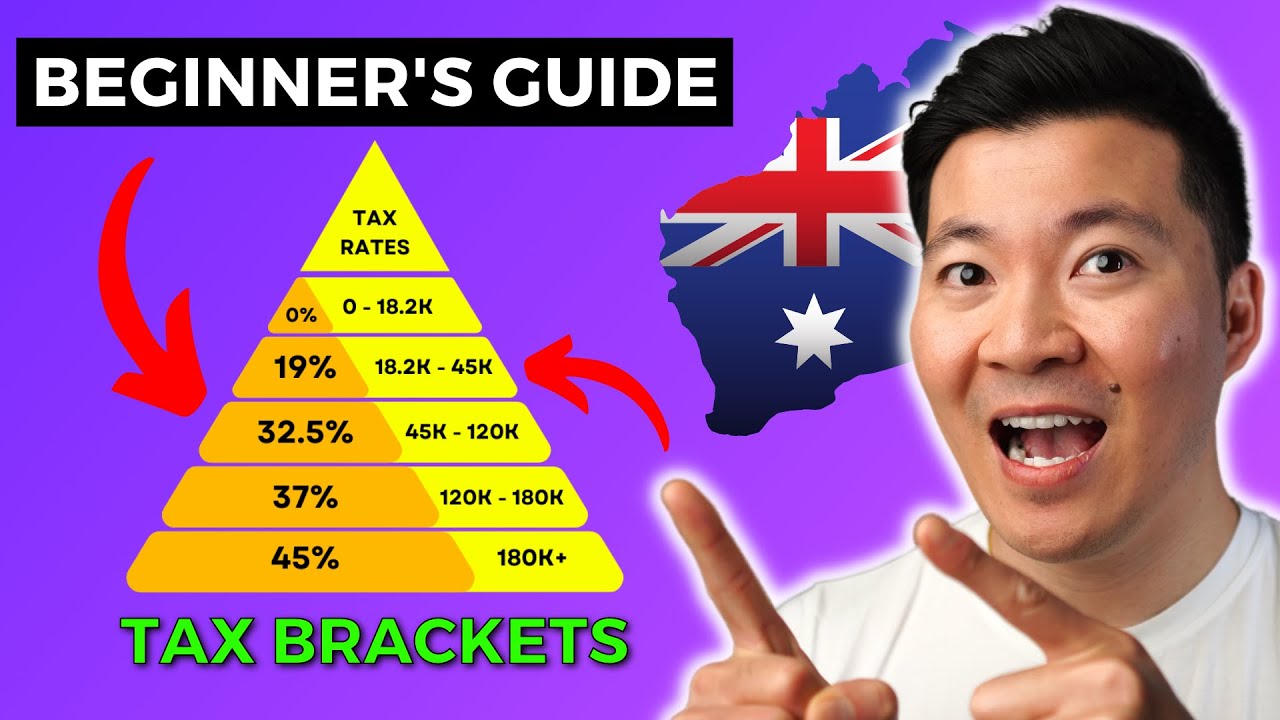

Tax Brackets Australia 202424

Tax Brackets Australia 2025-24. Learn how tax brackets impact an individual’s tax. These tax rates and thresholds were produced as an information service and without assuming duty of care.

A tax withheld calculator that calculates the correct amount of tax to withhold is also available. The inflation adjustments mean that taxpayers will need to earn more to hit a higher tax rate than they did in 2025.

Stage 3 tax cuts will be applicable from 1 july 2025 changing the tax brackets and rates for individual taxpayers.

Tax Brackets 2025 Australia Calculator Erinn Emmaline, Ato produces a range of tax tables to help employers work out how much to withhold from payments they make to their employees or other payees. Learn how tax brackets impact an individual’s tax.

Australian Tax Brackets 2025 2025 Company Salaries, When filing a tax return in australia, you must furnish details regarding your earnings, deductions, tax credits, and superannuation. Here's how the new tax brackets look at a glance:

How Australian Tax Brackets Work in 2025 Tax Explained For, Here's how australia's tax system works at the moment: New initiatives or legislation that may affect the individual tax return or supplementary tax return 2025.

Tax Brackets 2025 Australia Pdf Devi Kaylee, Australian resident tax rates 2025 to 2025. Australia will also implement a 15 per cent domestic minimum tax that will apply to income years starting on or after 1 january 2025.

Navigating the 2025 and 2025 FY Australian Tax Brackets — Stephen Cole, Learn how tax brackets impact an individual’s tax. Here's how the new tax brackets look at a glance:

Tax Brackets 2025 What I Need To Know. Jinny Lurline, The inflation adjustments mean that taxpayers will need to earn more to hit a higher tax rate than they did in 2025. Therefore, the tax payable on the taxable income of $126,800 is:

Individual Tax Rates 2025 Ato Calla Corenda, When filing a tax return in australia, you must furnish details regarding your earnings, deductions, tax credits, and superannuation. The tax rate for income between $120,001 and $180,000 is 37 cents for each dollar over $120,000.

Tax rates for the 2025 year of assessment Just One Lap, The financial year for tax purposes for individuals starts on 1st july and ends on 30 june of the following year. Australia residents income tax tables in 2025.

IRS Sets 2025 Tax Brackets with Inflation Adjustments, Ato produces a range of tax tables to help employers work out how much to withhold from payments they make to their employees or other payees. Australia will also implement a 15 per cent domestic minimum tax that will apply to income years starting on or after 1 january 2025.

Tax Brackets Australia 2025 grandmebel.moscow, A tax withheld calculator that calculates the correct amount of tax to withhold is also available. Use the income tax estimator to work out your tax refund or debt estimate.

The financial year for tax purposes for individuals starts on 1st july and ends on 30 june of the following year.

Use the simple tax calculator to work out just the tax you owe on your taxable income for the full income year.